Why Do We Pay Taxes? A Complete Guide Action Economics

If your bonds are in your TreasuryDirect account, your 1099-INT is available in your account by January 31 of the following year. Go to your TreasuryDirect account. Select the ManageDirect tab. Under "Manage My Taxes", choose the relevant year. Near the top of your "Taxable Transaction Summary", choose the link to view your 1099.

Savings Bonds Can Be Used for College, but Be Careful WSJ

A municipal bond that benefits a private entity is a private-purpose bond. The investor may have to pay taxes on the interest. more. Tax-Advantaged: Definition, Account Types, and Benefits.

How To Increase The Value Of A Business By Paying More Taxes

By default, you don't pay any taxes while you're holding I Bonds and earning interest during your lifetime. There's no RMD in I Bonds. TreasuryDirect doesn't charge any fees while you hold the I Bonds. You pay federal income tax on the amount of interest accumulated over the years only when you cash out or when the bonds reach maturity.

Do You Pay Taxes on Zero Coupon Bonds?

The government sets limits on how much you can invest in I bonds. You can buy up to $10,000 per year in electronic I bonds. However, if you use your tax refund to buy I bonds, you can buy an.

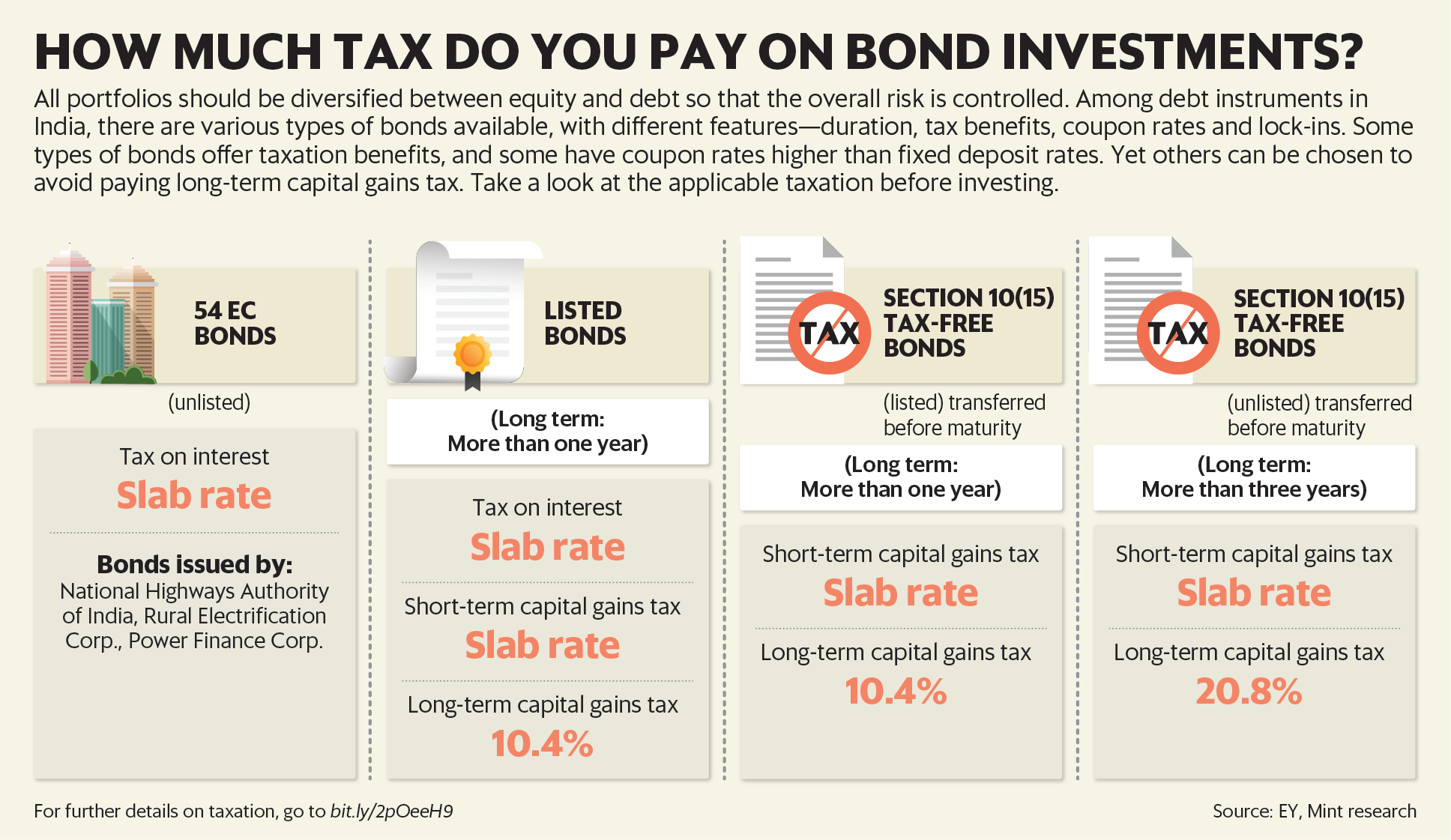

How much tax do you pay on your bond investments? Mint

You can choose to pay taxes on the interest earned when the I bonds are cashed. If you cash out any I Bonds in a specific year, then Treasury Direct will generate a 1099 tax form for the accumulated interest. The owner is responsible to pay for the taxes. This means that if you were gifted an I Bond, you must pay the tax owed.

Should I pay tax on Sovereign Gold Bonds (SGB)?

It's important to keep in mind that savings bond interest is subject to more than one type of tax. If you hold savings bonds and redeem them with interest earned, that interest is subject to federal income tax and possibly federal gift taxes (highly unlikely as the per-person cap is $10,000 and the gift tax exemption is $17,000). You won't pay state or local income tax on interest earnings.

What Are U.S. Savings Bonds? Definition, How They Work, Types, and

The exclusion is calculated as a pro rata amount of qualified education expenses divided by the redemption proceeds. For example, if the proceeds from an I bond are redeemed for $12,000 ($6,000 principal and $6,000 interest) and the qualified education expenses are $9,000, then the exclusion of interest is $4,500 ( [$9,000 ÷ $12,000] × $6,000).

Do You Pay Taxes on Settlements? Frost Law, Maryland Tax Lawyer

Rates on any older I bonds you're holding may be lower than 4.30%.. Their interest payments don't trigger state or local taxes and may be entirely tax free if used to pay for college.

How do I pay taxes on my I Bond interest?

A n I bond is a savings bond that earns two returns: a fixed interest rate and a variable inflation rate. New owners may wonder: Do I pay taxes on I bonds? The answer in most cases is yes, but.

How much tax do you pay on your equity investment Mint

Yes, you are required to pay federal income taxes on the interest earned by inherited series I savings bonds. The interest is taxed in the year it is earned and must be reported on the beneficiary.

Do You Pay Taxes on Zero Coupon Bonds?

Taxation of municipal bonds. Income from bonds issued by state, city, and local governments (municipal bonds, or munis) is generally free from federal taxes.*You will, however, have to report this income when filing your taxes. Municipal bond income is also usually free from state tax in the state where the bond was issued.However, keep in mind that:

The Importance of Paying Your Taxes University Herald

The Tax Court recently addressed this exact set of facts. In the case, a man who inherited a savings bond from his dad had it reissued in his name and later redeemed it. Treasury Direct sent him a.

How to Pay Your Taxes YouTube

The answer, at least from a tax perspective, can be surprising. Although Series EE bonds (aka "college bonds") are a very "vanilla" investment, their tax treatment is anything but. In fact, the tax treatment of these bonds is highly complex and making the right choice - yes, you actually have a choice in how you're taxed - can.

Treasury Bond vs. Bank CD Rates Adjusting For State and Local

The Tax Paperwork Isn't. The tax bill is coming due for one of the hottest investments of the past two years. Millions of Americans rushed to buy I bonds in 2022 when a guaranteed 9.62% interest.

How much tax do you pay on bond investments Mint

Best High-Yield Savings Accounts for April 2024—Up to 5.50%. Monthly interest for I bonds is always paid on the first day of the month, and is not pro-rated throughout the month. So whether you.

Paying Taxes 101 What Is an IRS Audit?

According to Treasury Direct, interest from EE U.S. savings bonds is taxed at the federal level but not at the state or local levels for income. Bonds typically earn interest, which is the amount.